HFSS & The Sweet Future of UK Sugar

Background

In July 2020, in an attempt to tackle the growing obesity problem in the UK, the government announced new restrictions for food and drink products high in fat, sugar, and salt (HFSS).

With 64.3% of adults and 14.4% of reception-age children being either overweight or obese, the restrictions will intervene in how HFSS products are sold and promoted in-store and online and have implications for retailers, brands, and manufacturers.

Early in the year, The Grocer’s HFSS Clampdown Conference brought together industry leaders Unilever and Coca-Cola as well as policy makers and public health scientists to discuss the implications of the new restrictions for the industry and the consumer. The conference highlighted that nearly half of all businesses that’ll be affected (42%) are unprepared.

This guideline gives an overview of the HFSS restrictions, what this means for FMCG brands and how best to navigate the post-HFSS environment.

Will HFSS restrictions help reduce obesity rates in the UK?

According to research by IGD, 58% agree that HFSS will help make their household diet healthier. But what consumers say and do are often two different things. HFSS products make up 10% of the weekly shopping basket and habits are hard to break. In addition, the cost of living crisis will also impact the cash strapped consumer’s behaviour. The interventional approach is not the magic bullet for obesity. The HFSS restrictions might nudge consumers towards healthier choices but for the long-term, behaviour change economics (making healthy food affordable) and educating consumers about healthy options are also necessary.

What are HFSS products?

Very broadly, HFSS products are pre-packed food and drinks that contain high fat, sugar, and salt and can be bought in-store and online. Free refills of sugar-sweetened beverages in the out-of-home sector are also considered HFSS.

Most food and drinks categories are affected, including soft drinks with added sugar ingredients, savoury snacks, confectionery including chocolate and sweets, cakes and cupcakes, desserts and puddings, yoghurt and fromage frais (with added sugar) and pizzas, chips, and potato products.

How is HFSS calculated?

The Nutrient Profile Model (NPM) is the tool that calculates whether a product is HFSS. It is a complex points-based system that involves multiple steps and factors in different ingredient scores.

Foods that score four or more, and drinks that score one or more are classified as HFSS. The HFSS score does not need to be on the packaging.

What are the new HFSS restrictions?

The scope of the new restrictions covers three key areas:

Location (effective from October 2022)

Volume promotions (effective from October 2023)

Advertising (effective from January 2024)

1. Location: in-store and online equivalent locations.

Retailers will no longer be able to position HFSS products in ‘prime’ locations, which are known for nudging consumers to make an impulse buy and driving pester power. For example, check-out locations or end of aisles where consumers ‘grab & go’ easily. Considering that 67% of consumers always keep an eye out for special offers on gondola ends, this new restriction will impact retailers and brands.

Similarly, placing HFSS products on online check-out pages will be prohibited, and so is listing them as ‘favourite/recommended’ products. Home page and pop ups are other restricted areas.

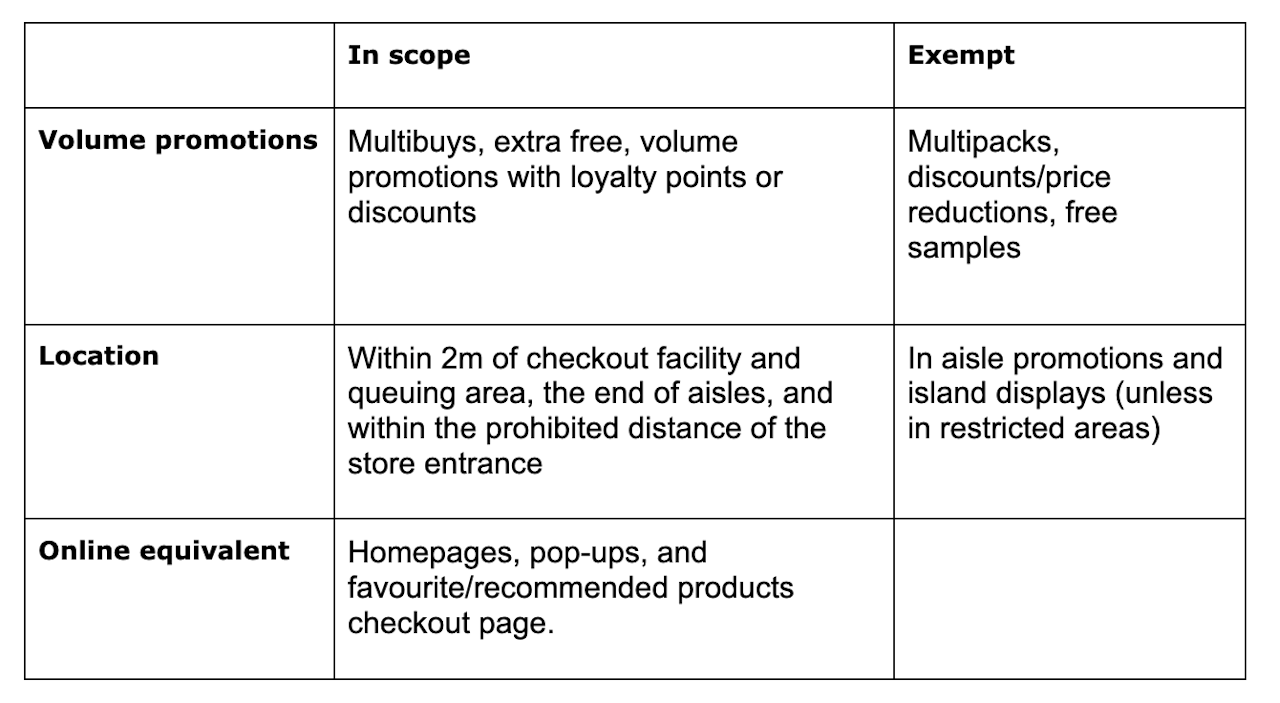

2. Volume promotions: in-store and online equivalent locations.

Volume promotions include multi-buy (e.g. BOGOF, buy 3 save 25%), extra free (e.g. 50% extra free), and volume promotions with loyalty points or discounts. However, non-volume promotions such as multipacks, free samples and discounts are exempt.

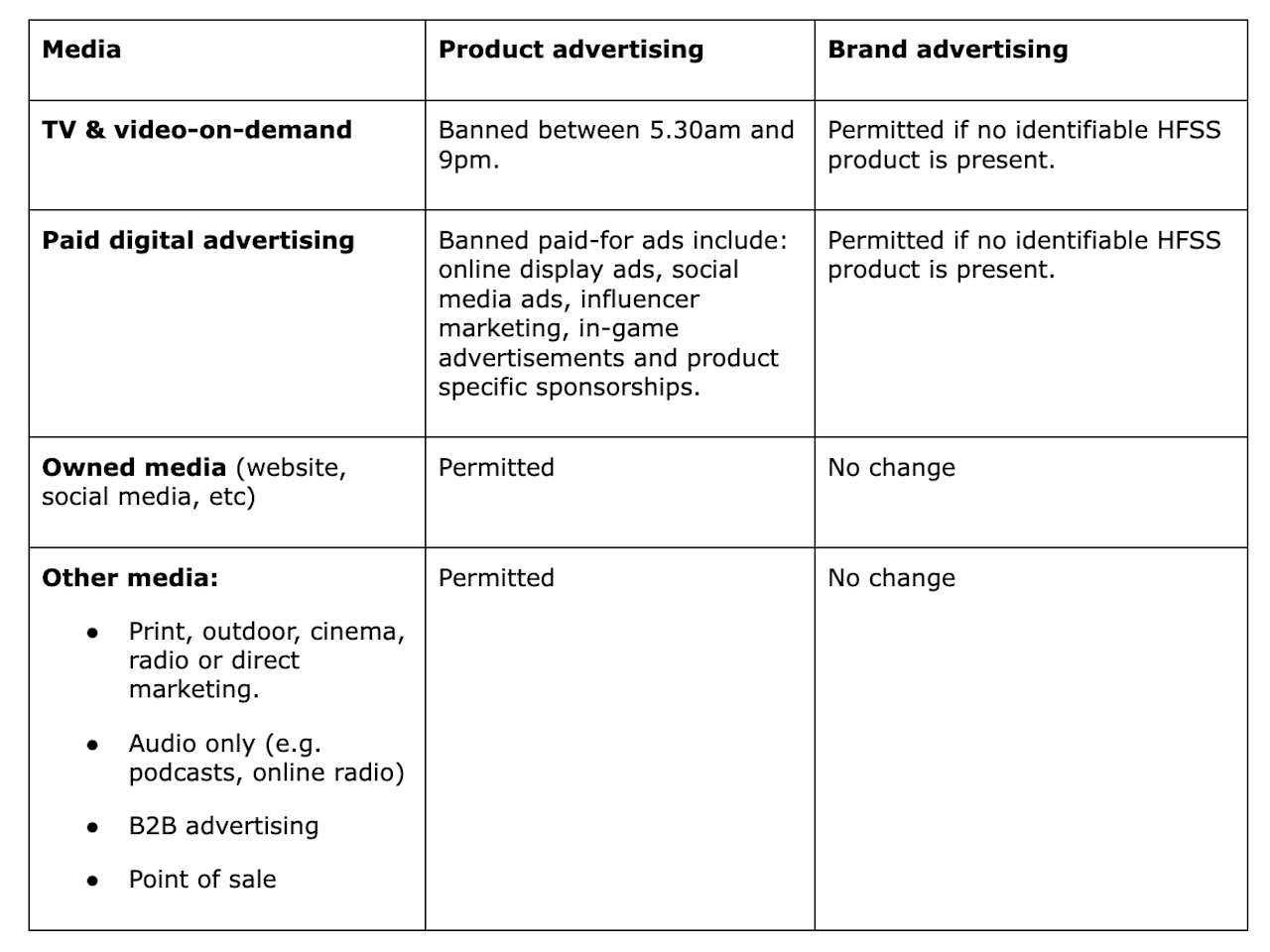

3. Advertising

Product advertising: A total ban on paid product advertising online is planned to be introduced in January 2024. This includes influencer partnerships and any UGC that is paid with products. A 9pm watershed on TV and video on demand will also be effective from the same day.

Owned media (e.g. website, blog, social media) and print, outdoor, cinema, radio, or direct marketing will be exempt.

Paid brand advertising is still permitted, provided that no ‘identifiable’ HFSS product is present. There is still ambiguity around the definition of the ‘identifiable’ HFSS product.

What can Food & Drinks brands do to adapt to the new HFSS restrictions?

As we work with our FMCG brands, we are adapting our approach to the new market dynamics. Despite the new challenges, our point of view is that there are golden opportunities for brands to improve brand health and performance long term by communicating their value and meaningful difference. With restrictions on product advertising, building relationships with consumers is now more crucial than ever to claim mental availability.

Audit your brand positioning: new brand advertising opportunities are opening up. Is your brand positioned to capitalise on these and achieve long-term brand and revenue growth?

Audit your media strategy: what do you need to change to increase visibility and loyalty in the new landscape? For example, if TV broadcast represents the largest share of revenue, what strategies can still generate demand?

Owned media will become more important, focus on improving followers to those channels with content, SEO and creative campaigns.

Other than TV and online, consider other media that are outside the scope. Partnerships, audio, podcast, experiential marketing have already proved to be successful channels for reaching and connecting with consumers.

Packaging will do the heavy lifting in-store. A distinctive and consistent packaging design across the entire product portfolio helps the consumer navigate between the category on the shelf.

Taste is non-negotiable for HFSS food and drinks. While celebrating your HFSS products and aligning your marketing, your innovation pipeline could consider new technologies without compromising taste.

Who is affected by the HFSS restrictions?

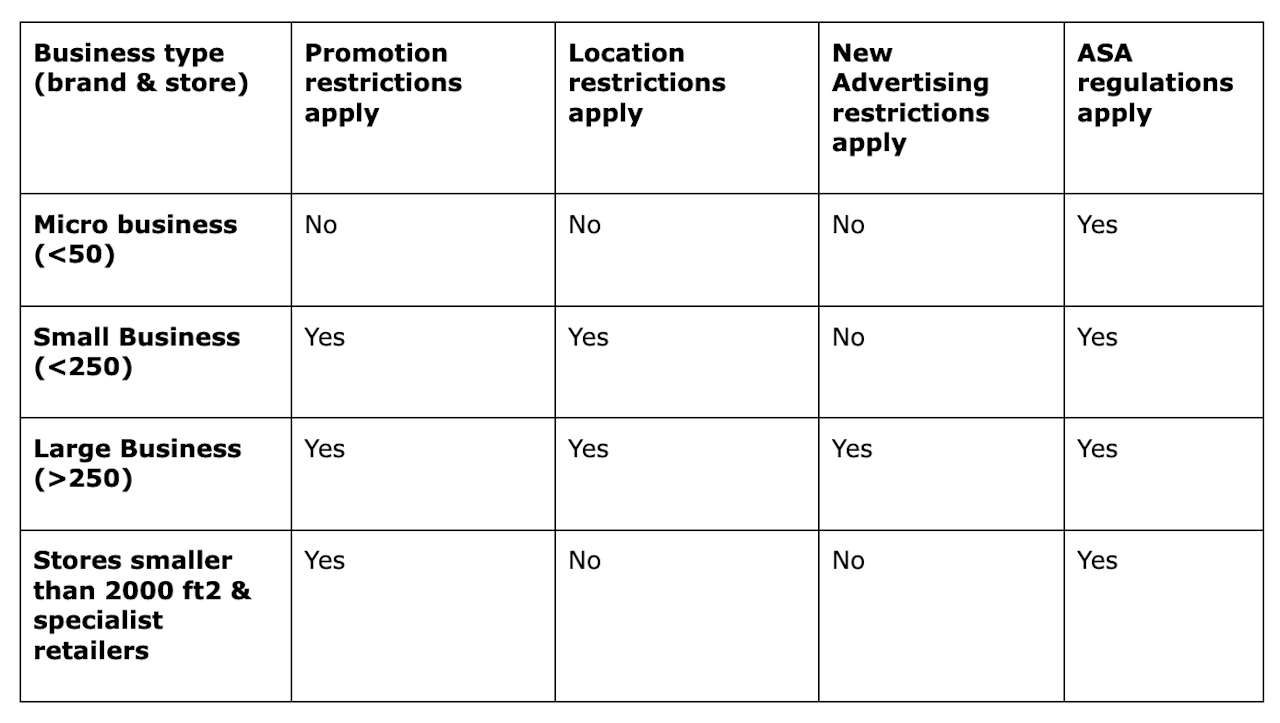

The size of a business will determine whether or not the restrictions apply to its products.

Promotion and location restrictions: If you are a micro or small business owner with less than 50 employees, your products will be exempt from all restrictions. Similarly, stores smaller than 2000 ft2 and specialist retailers such as chocolateries and bakeries are exempt from location restrictions.

Advertising: The advertising restrictions will only apply to large businesses with 250 or more employees. SMEs with less than 250 employees will be exempt.

All businesses, including SMEs, will continue to be subject to the existing advertising rules set out by the ASA.

Are small brands gaining an advantage over big brands?

The HFSS regulations help level the playing field for small brands. They might finally have a chance to increase in-store visibility and gain an advantage in the product marketing space online. However, they still have to shift large volumes to stay on the shelf or even to get on the shelf in the first place.

With such a big shake-up, delisting of poorly performing SKUs or opening the shelf space for ‘healthier’ brands are some of the options for retailers. The industry is unsure how to play the new game with minimum disruption to their bottom line. Retailers are busy testing and learning how consumers will behave in this new environment.

One thing is almost certain: the shelf space, especially the premium shelf space, will become even more expensive. Big brands will still have the buying power to position themselves in the ‘new’ premium shelves.

For smaller brands, the challenge of reach and visibility outside the store still exists. Big brands will continue to claim a bigger share of airtime with brand advertising on TV and will have the budgets to experiment with multiple media and mediums. Yes, this could be an opportunity for smaller brands but the challenges around funding to compete with big brands will still be there.

At AgencyUK, we specialise in integrated brand communications (strategic, digital and creative). We have been working with food & drinks brands since 2008 and recently have helped our clients navigate the new HFSS advertising restrictions.

References:

HFSS and the future of grocery retail: Unpacking the new rules